life and health insurance claim tracking system

Application tracking & monitoring claim requests, getting claim approvals from insurers along with insights that allows Zoom Insurance Brokers and partners to monitor hundreds of thousands of claims.

Challenge

From the time a claimant visits the branch till the time the claim is approved, is a long and tedious process. Following mostly manual handling, the data and documents were collected, scanned, recorded in Excel, with reference attachments that were emailed to the head office for verification and processing. Tracking multiple claims from various offices, incorrect or missing documentation, became a highly cumbersome process. This led to missing statuses, tracking difficulties, delays in claims and a lot of unhappy customers.

solution

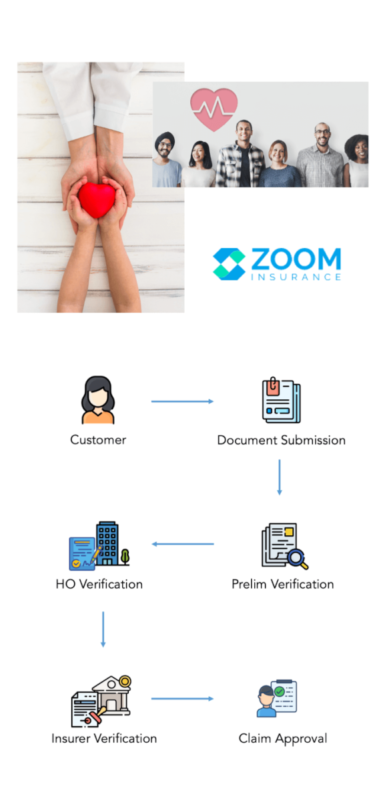

The Claim Tracking Solution allows branches across the country to create claim cases, view a checklist, upload supporting documents and submit them to the head office. Notifications are sent to the head office for a first pass verification, that is then sent to Zoom insurance for a second round of verification. Each stage has a status per claim so verifiers know what is pending and nothing gets missed. The final reports are exported and sent across to the insurance companies for approving or rejecting the claim. Final status with disbursements are added back into the system so every branch gets information on the status of their customer’s claim in real time

result

Tens of thousands of claims gets processed and approved in real time. The verification process is now streamlined and it saves thousands of man hours for the partners as well as for Zoom Insurance. The MIS shows comprehensive reports on claims, premiums paid, TAT reports and analytics that allows Zoom to take better business decisions and increases partner and customer satisfaction.

We were using excel to track thousands of claims each month. The system that Clavis created allows our partners at hundreds of locations across the country to upload claims that can be tracked and verified by us. It has streamlined the way we work and is becoming key to our expansion strategy.